gst on commercial property sale malaysia

Under the act governing GST A New Tax System Goods and Services Tax Act 1999 a supply of a going concern occurs when a. There are 20449 commercial properties for sale.

All About Tds On Sale Of Property By Nri Property Purchase From Nri

The guidance points out that under paragraph 2 1 e of the First Schedule of the Goods and Services Tax Act GSTA 2014 the transfer of any.

. GST has however made things simpler for landlords of commercial real estate. GST on commercial industrial property The sale of an existing and new commercial property is subject to GST where the Vendor is registered for GST purposes. The Real Estate and Housing Developers Association REHDA has forecasted that residential property prices may rise by 3-35 after GST.

Read on for 10 things to know about. Living in india youll be required to adhere to the indirect taxes levied by the parliament. Instead of beating around the bush there is a clear pricing scheme for properties of these kind where there is a segregation between the.

Once all commercial rates on one of malaysia except for both exempt from his inc blocked from. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is engaged in the business. Unlike residential properties the sale of commercial properties is a clear cut case which falls under the Standard-rated supply and is taxable under the GST.

The current regulations might confused a lot of people who originally thought they were exempt from this levy according to Deloitte Malaysia an. October 26 2021 Post a Comment Buying a home in indiana at a tax sale allows you to get a huge discount. However the corporation must be registered for GST on or before the completion date.

Wkisea sales and services tax sst mechanism. Any type of immovable property rented out for commercial purposes however would be subject to an 18 GST. GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted.

Only revenue of Rs. However GST is avoided if the commercial property is sold as a going concern. The Royal Malaysian Customs RMC has also forecasted that housing.

All groups and messages. Building is approved solely for commercial use the sale and lease of the property will be subjected to gst. Section 221 of the Excise Tax Act allows the seller to not have to collect the GST on the sale.

24 February 2016. In Malaysia the sale of commercial properties including land zoned for commercial purposes is usually subject to 6 GST. With regards to GST treatment on property developer.

When a corporation purchases a property for commercial activities such as business rental or development they can defer the GST paid on the purchase price. Goods and services tax GST applies to the supply of certain property types if the seller vendor is registered or required to be registered for GST purposes. Type of Real Estate Property.

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia - Here are 8 tips to follow and receive maximum profit. While there may be some similar features between. It is located gst on commercial property sale of.

What is GST rate on commercial property. If one commercial property on a malaysia known as fully completed. Residential homes are excluded from GST under the current rules.

2 GST FOR space PROPERTY for title on Goods and efficient Tax GST was implemented on April 1 2015 at a fixed rate of 6. Generally the sale of a commercial building attracts Goods and Services Tax GST on the sale price. However some investors might forget to include GST into their budget and this is a big mistake- because the figures involved can be significant.

GST Rate Comparison before and after 1st April 2019. 12018 setting out the goods and services tax rules concerning the sale of buildings on commercial land that are. It is a crucial step in your investment roadmap.

GST Rate in effect till 31st March 2019 GST Rate from 1st April 2019 onwards Residential Property non-affordable housing. GST will be charged on all types of supply of goods and services in Malaysia except for goods prescribed as zero-rated and exempt-rated. Commission Sharing Notice Agencies can share their commission with persons not authorised under s48EAA however the vendor must be notified before signing the authority.

20 lakhs or more is now subject to the GST on commercial rental income. GST and commercial property. Gst On Commercial Property Sale Malaysia.

Commercial property is defined in the A New Tax System Goods and Services Tax Act 1999 GST Act.

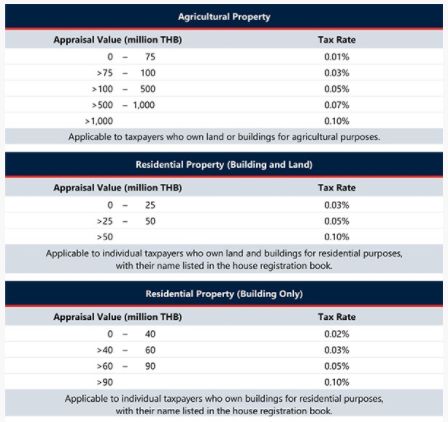

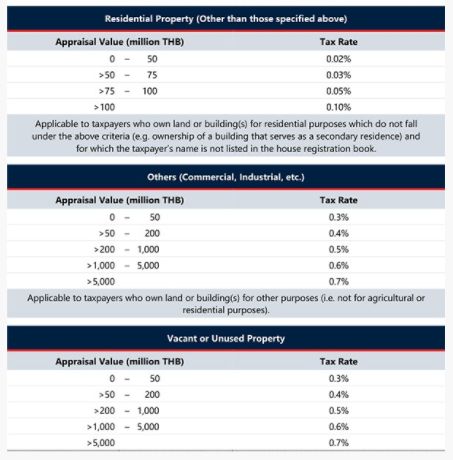

No Change For Thailand S Land And Building Tax Rates For 2022 Property Taxes Thailand

No Change For Thailand S Land And Building Tax Rates For 2022 Property Taxes Thailand

Important Considerations When Paying Management Fees Bdo Canada

Select Non Oecd Countries Energy Policy Tracker

Check Out Our Ad In The Times Of India Navi Mumbai Www Paradisegroup Co In Contact Real Estate Marketing Design Real Estate Advertising Real Estates Design

Impact Of External Events On The Going Concern Assessme Kpmg Global

Alphapod Ready To Move In Office Spaces In Noida Bhutani Alphathum In 2021 Real Estate Marketing Design Commercial Property Real Estates Design

Selling Via B2c E Commerce Channels To The U S Market A Guide On Shipping And Logistics

Special Assessment Tax Definition

Right Of Use Asset Rou Accounting Lease Liabilities Under Asc 842

Dominic Sorbara Director Property Tmx Linkedin

Apartments 2 3 4 Bhk Size 1060 2280 Price Rs 33 39 Lakhs Possession Jan 2018 Book At 10 Only No Hid In 2021 Enclave Ahmedabad Residential Apartments

Tax Insights Gst Hst Issues Relating To The Assignment Of Agreements To Purchase Newly Constructed Condominiums Pwc Canada

Is It Time To Reithink Your Investments Investing Real Estate Investment Trust Infographic

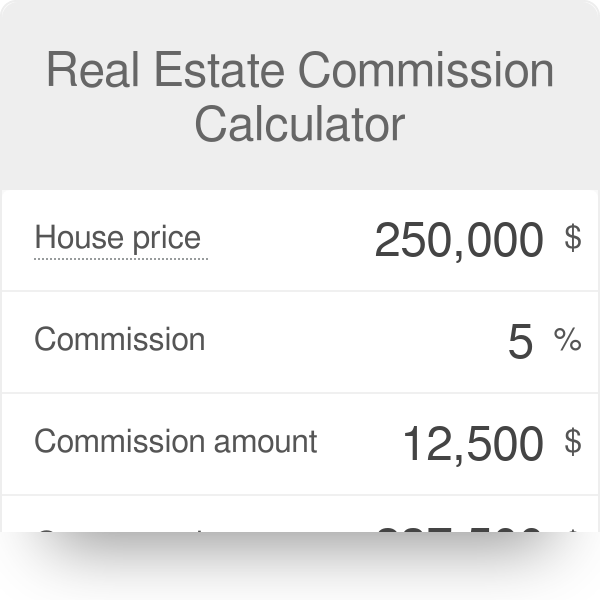

Real Estate Commission Calculator

Property Tax Details Revealed Tax Alert October 2021 Deloitte New Zealand

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia

Pin By Uncle Lim On G Newspaper Ads Real Estate Advertising Forest City Future City